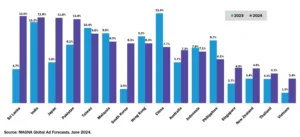

The ad economy in the Asia Pacific is forecast to grow +8.5% in 2024 to reach $289 billion. This follows growth in 2023 of +9.5%.

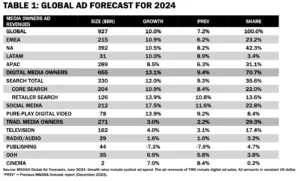

MAGNA’s “Global Ad Forecast” has released its summer update and is predicting net advertising revenues (NAR) will reach $927 billion this year, growing +10.0% over 2023.

This forecast marks a significant acceleration in the +6.4% global growth recorded in 2023 said MAGNA. Neutralizing the impact of cyclical events in 2023 and 2024, the normalized acceleration is still real but more modest: non-cyclical ad revenues grew by +7.5% in 2023 and will grow by +8.7% in 2024.

The APAC outlook – 8.5% Growth

The advertising economy in Asia Pacific will grow by +8.5% in 2024 to reach $289 billion. This follows 2023 growth of +9.5% to reach $266 billion. This is taking place in a slightly slowing, but stable, economic environment where real GDP is expected to grow by +5.2% in 2024 according to the IMF. Inflation in APAC has continued to decline and while some economies are still seeing sustained price pressures, others are facing deflationary risks. Global disinflation and the prospect of monetary easing have increased the likelihood of a soft landing.

Overall APAC growth of +8.5% in 2024 consists of traditional media owners seeing +0.8% growth to reach $68 billion (24% of budgets), and digital pure player publishers seeing growth of +11.1% to reach $220 billion (76% of budgets). Television budgets are stabilizing in 2024 and are expected to be up by +0.2% following 2023’s -2.3% performance. This increase in growth is primarily driven by the tailwinds of sporting events – primarily the Paris Olympics. The UEFA Euro 2024 tournament and other sporting events typically have only a minor impact in APAC markets.

“The digital dominance in APAC is expected to persist, with digital revenues forecast to account for 81% of total budgets by 2028, up from 76% in 2024,” said Leigh Terry, CEO IPG Mediabrands APAC.

“This shift underscores the growing importance of digital channels in reaching and engaging consumers in the region. Sri Lanka, India, and Japan are poised for significant growth in 2024, with mature markets in the region also showing signs of recovery, and contributing to the overall positive outlook for APAC.”

APAC net ad revenue growth 2023 & 2024

Key Takeaways

- The summer update of MAGNA’s “Global Ad Forecast” predicts that global media owners’ advertising revenues will reach $927 billion this year, growing by +10%.

- MAGNA is raising its 2024 growth forecast following a stronger-than-expected ad market in the first quarter (+12%) and an improvement in the economic outlook (real GDP growth +3.2%, APAC +5.2%).

- The advertising revenues of traditional media owners (TMO) – from the television, radio, publishing, and out-of-home media industries – are expected to grow to $272 billion, a +3% increase that represents a noticeable improvement compared to 2023 (-4%).

- TMO ad sales are driven by a record number of cyclical events and a +11% growth in TMO’s non-linear ad sales (e.g. ad-supported streaming +18%) that are now accounting for one quarter of total TMO ad revenues.

- The advertising sales of Digital Pure Players (DPP) will increase by +13% to reach $655 billion.

- DPP ad sales are boosted by increased competition in ecommerce, the rise of retail media networks ($146 billion this year), and better monetization of short vertical videos in video apps and social media apps.

- Keyword Search remains the largest digital ad format, growing by +12% to reach $330 billion this year. Social Media owners (e.g., Meta, TikTok) accelerate (+18% to $212bn), while short-form pure-play video platforms (e.g., YouTube, Twitch) grow by +14% to reach $78 billion.

- Among the most dynamic ad markets this year: Spain (+14%), India and the UK (both +12%), France and the US (both +11%). Germany and China are both experiencing economic difficulties and slower-than-average advertising spending (both +8%).

- The APAC ad market will grow by +8.5% this year to $289 billion. Traditional Media Owners ad sales will grow by +0.8% to $68 billion while DPP ad revenues will expand by +11.1% to $220 billion.

- Automotive and CPG/FMCG brands will be among the fastest-growing ad spending verticals this year, while Finance re-accelerates and Government expands due to the many elections taking place this year.

Busy year for cyclical events

2024 will be busy with cyclical events taking place, including four major sports tournaments (Paris Olympics, UEFA Euro 2024, Copa América hosted by the US, and the ICC T20 Cricket World Cup hosted by the US and the West Indies), and general elections in five major markets (Mexico, India, US, France, and the UK).

The first three elections take place in countries with little or no restrictions on political advertising, therefore moving the needle in terms of advertising sales.

Overall, the 2024 cyclical events will provide 1.3% extra growth to global ad revenues this year, 5% extra growth for television, 0.5% extra growth for digital media, and almost 2% extra growth for the US market alone.

“MAGNA was always expecting a strong ad market in the first quarter of 2024, due to a comp effect (1Q23 was extremely weak),” said MAGNA.

“Based on our analysis of media companies’ first-quarter financial reports, 1Q24 was even stronger than expected. Year-over-Year growth averaged +12% in key markets, +17% in Spain, +15% in France, and Germany.

It added: “Quarterly growth rates will gradually slow as comps become tougher in the second half, but this strong start of the year, coupled with a stronger economic outlook, led us to raise the full-year 2024 forecast for almost every individual market we monitor, bringing the expected global growth from +6.4% in December to +10% now. The full-year ad revenues of traditional media owners are now forecast to grow by +3% instead of +2%, and the ad sales of digital pure players are now expected to grow by +13% (previously +9.4%).

MAGNA released the following summary:

Traditional media owners (TMO), historically focusing on Television, Audio, Publishing, OOH, and cinema media, will grow ad revenues by +3% globally in 2024, to reach $272 billion. TMO’s non-linear ad sales (e.g., ad-supported streaming, digital audio, publishers’ digital ad sales) are now accounting for +25% of total TMO ad revenues and supporting advertising growth while traditional linear ad sales are stagnating.

Ad-supported streaming is taking off in 2024, as traditional TV players (e.g., Disney+, Max, ITV Hub, Joyn, TF1+, etc.) and pure streaming players (Netflix, Amazon) will generate at least $18 billion this year (+16%). Amazon has already introduced an ad-supported tier on Prime Video in most large markets in the first half of 2024, including the US, Canada, Mexico, France, Germany, Italy, Spain, and the UK. Everywhere users are defaulted to the new ad-supported tier, and MAGNA believes most users will permanently remain on that tier rather than upgrade to a more expensive ad-free tier. Other streaming platforms are introducing such ad tiers in more markets (e.g., Max in Latin America in Feb. 2024) while the rising cost of ad-free options makes the ad-supported tiers increasingly attractive.

Cross-platform television remains the largest traditional media with total ad sales reaching $162 billion this year (+4%) as media owners benefit from cyclical events and rapid growth of ad-supported streaming. Publishing ad sales will remain subdued (-3% to $44 billion) while Radio ad sales reach $29 billion (+2%). After finally catching up with the pre-COVID levels in 2023, OOH media continues to show significant organic growth (+7% to $35 billion) driven by additional screen units generating digital OOH growth (+12%, reaching almost 40% of global OOH ad sales), and by omnichannel programmatic spending.

Digital Pure-Play (DPP) media owners, offering Search/Commerce, Social, Short-Form Video, Static Banners, and Digital Audio ad formats, will reach $655 billion this year, growing by +13% over 2023, and accounting for 71% of total ad sales. DPP ad sales are fueled by multiple organic growth factors including the rise of ecommerce, the rise of retail media networks providing much-needed consumer data to the programmatic ecosystem, growing digital penetration in emerging markets, and better monetization of the rapidly growing short vertical video formats in social and video apps.

Keyword Search will remain the largest digital advertising format, reaching the $330 billion milestone driven by Retailer Search (e.g., Amazon and product listing ad retail media, +14% to $126 billion) and Core Search (e.g., Google, Bing, Baidu, +11% to $204 billion). Social Media ad sales (e.g., Meta, TikTok) will grow by 17.5% to $212 billion, while Short-Form Pure-Play Video platforms (e.g., YouTube, Twitch) will expand ad revenues by +14% to $78 billion.

Markets: India and Spain Among the Most Dynamic

According to MAGNA, the economic outlook is the primary factor behind advertising spending decisions, and economic activity is so far stronger than previously expected this year. In its April report, the IMF raised its 2024 GDP growth forecast for the world (from +2.9% to +3.2%), for the US (from +1.5% to +2.7%), for China, India, and Brazil.

“The forecast was lowered, however, for France and Germany, but as it happens, these two markets will benefit from hosting major sports events to support marketing and advertising activity. Meanwhile, inflation is slowing down everywhere and expected to hover between +2% and +3% in most large markets, which is still above the long-term target of monetary institutions but low enough to no longer hurt the sales and marketing efforts of CPG/FMCG brands,” said MAGNA.

Among the most dynamic ad markets this year: Spain (+14%), India and the UK (both +12%), France and the US (both +11%). Germany and China are both experiencing economic difficulties and slower-than-average advertising spending (both +8%).

It added that in the US, media owners’ ad revenue will increase by +10.7% to $374 billion. The US remains the largest and most intense ad market in the world, with advertisers spending $1,100 per consumer in 2024; it’s 8 times more than the global average ($160), ten times more than China ($110), and a hundred times more than India ($10).

Read the full report here.